Noi margin real estate

It is calculated by deducting the companys cost of. NOI is a real estate metric that stands for net operating income and measures the profitability of an income-generating real asset.

Yield On Cost A Metric For Real Estate Investors And Developers Realdata Software

Newcomb is a neighborhood of homes in Columbus Wisconsin offering an assortment of beautiful styles varying sizes and affordable prices to choose from.

. The vast majority are below 60 with a. Newcomb homes for sale range in. Net operating income is a valuation method that real estate professionals use to determine the value and profitability of an income-generating property.

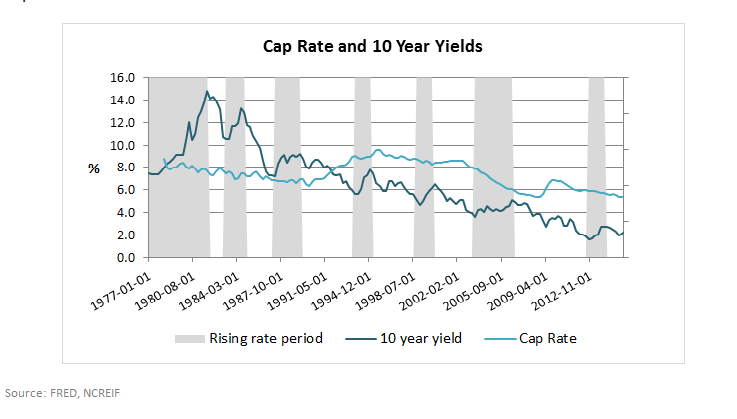

View 1518 homes for sale in Arlington WI at a median listing home price of 250000. The cap rate is another metric in real estate investing which you calculate by dividing the NOI by the propertys value. Sample 1 Sample 2.

All I had to do was to apply a geometric mean growth rate in the interim years to arrive at Year 5 rental rate provided. See pricing and listing details of Arlington real estate for sale. Evansville WI Real Estate Law Attorney 608 882-5944.

In general real estate NOI is. NOI Margin means NOI divided by the total revenues from properties as presented in the combined statements of income prepared in accordance with IFRS. This can be viewed as the rate of return on a rental.

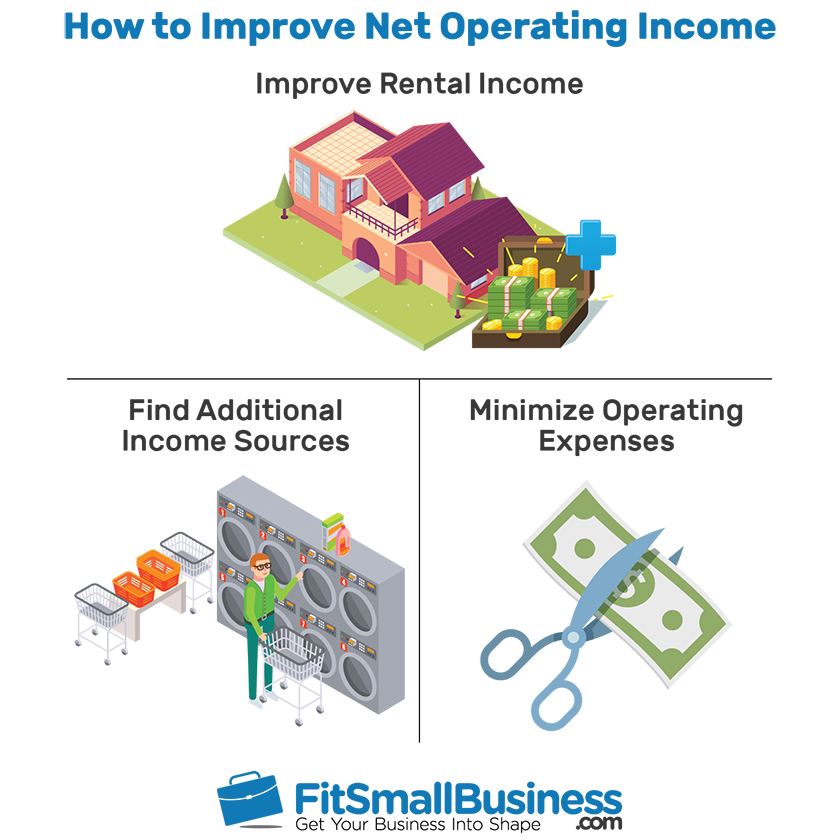

By plugging the above income and expenses number into the NOI formula we can determine the propertys expected annual net operating income. NOI is an essential figure to calculate in order for real estate operators to assess the potential. The net operating income formula is calculated by subtracting operating expenses from total revenues of a property.

Net Operating Income As shown in the net operating income formula above net operating income is the final result which is simply effective gross income minus operating. NOI is the annualized income after operating expenses from a property. Claimed Lawyer Profile Social Media.

As I mentioned earlier revenues include more than just rental income. The net operating income NOI of a property is used to determine its ability to generate money in the real estate market. Net Operating Income NOI Definition.

Prairie du Sac WI Real Estate Law Attorney 608 643-3391 Marquette University Law School Wisconsin Avvo Martindale-Hubbell Lawyer Services National Association of Distinguished. Potential rental income. Brodhead Real Estate Lawyers.

The model by definition is pretty simple and the one big. The firm took a random sample of over 300 deals that came out over the two years and then calculated the actual NOI margins.

Commercial Real Estate Lending Finding Economic Profit In A Difficult Industry Mckinsey

Are Real Estate Cap Rates About To Rise Soon Seeking Alpha

Multifamily Apartment Proforma Excel Template Propertymetrics

Use Our Investment Model To Balance Your Real Estate Portfolio Victory Property Management Premium Rental Homes Apartments

Yield On Cost A Beginner S Guide Propertymetrics

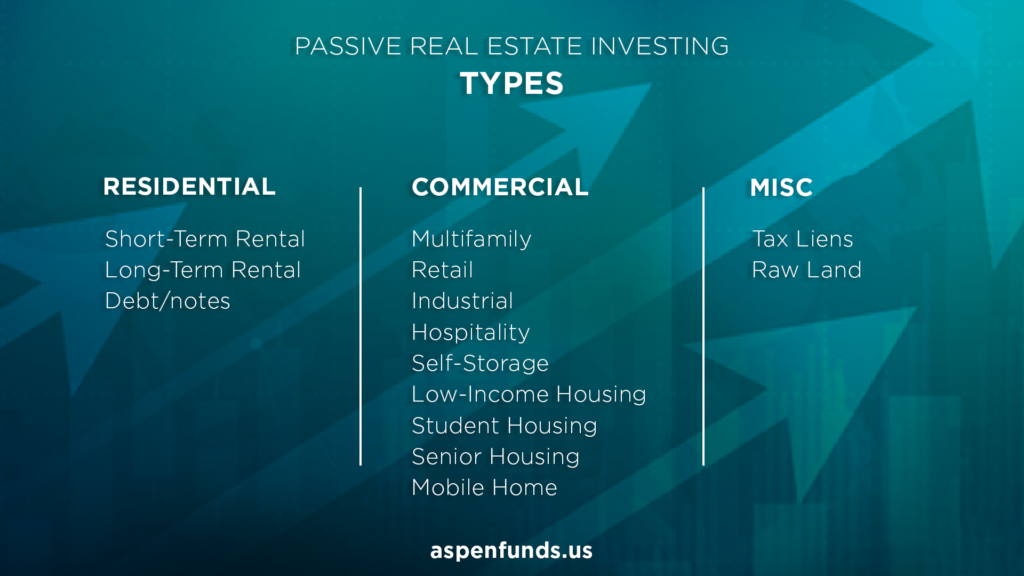

Passive Real Estate Investing In 2021 The Complete Guide

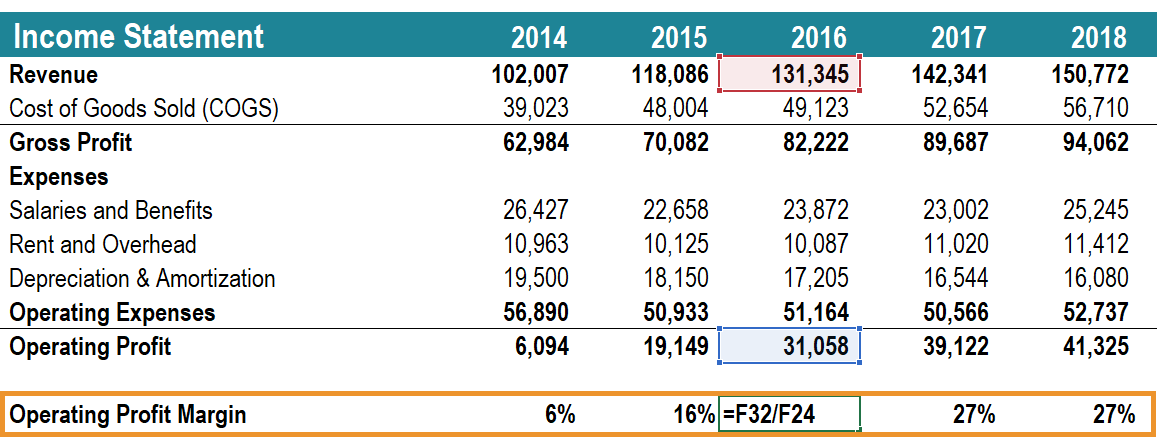

Operating Profit Margin Learn To Calculate Operating Profit Margin

Passive Real Estate Investing In 2021 The Complete Guide

What Is Irr In Real Estate Feldman Equities

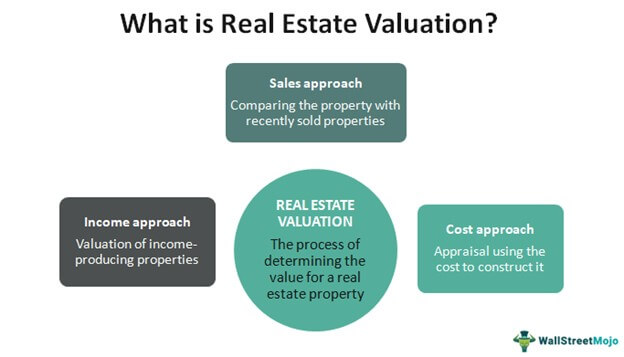

Real Estate Valuation Meaning Methods And Examples

Profit Margin Guide Examples How To Calculate Profit Margins

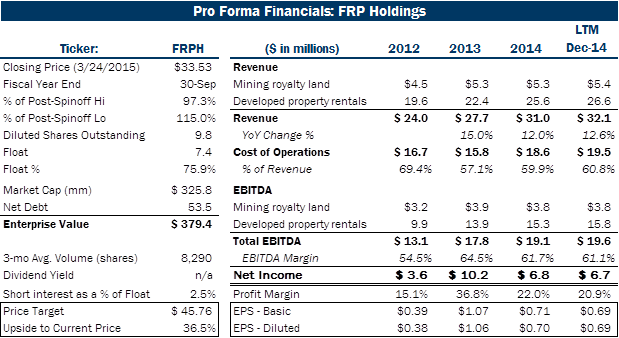

Frp Holdings Small Cap Real Estate Spin Off Valued At 35 Premium To Current Market Value Nasdaq Frph Seeking Alpha

Vietnam Real Estate Market Prospect In 2021 Allnations Hebronstar

Yield On Cost A Beginner S Guide Propertymetrics

Real Estate Tri Fold Brochure

Net Operating Income For Real Estate Investors How To Calculate Noi Formula

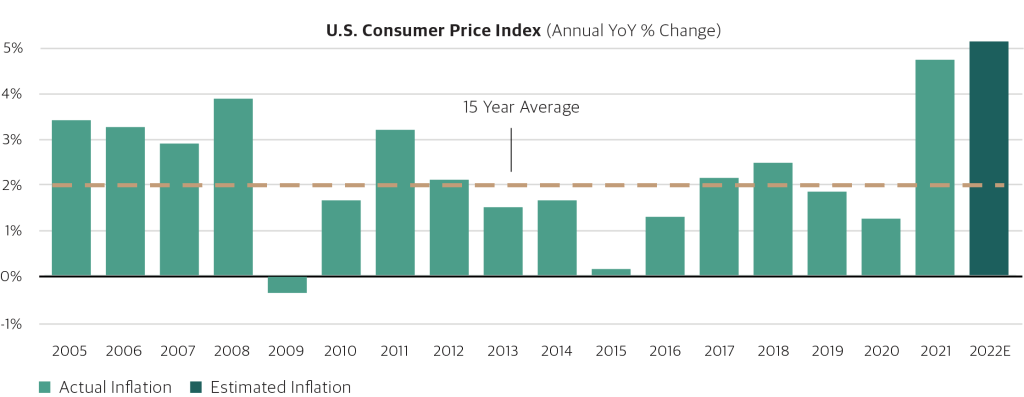

Real Estate Investing At An Inflation Inflection Point Blackstone Private Wealth Solutions